Chapter 7 Vs Chapter 13 Bankruptcy Fundamentals Explained

Chapter 7 Vs Chapter 13 Bankruptcy Fundamentals Explained

Blog Article

The Only Guide to Tulsa Debt Relief Attorney

Table of ContentsTop Guidelines Of Which Type Of Bankruptcy Should You FileExcitement About Tulsa Bankruptcy Filing AssistanceMore About Top Tulsa Bankruptcy LawyersThe Single Strategy To Use For Bankruptcy Attorney Near Me TulsaNot known Factual Statements About Which Type Of Bankruptcy Should You File See This Report about Tulsa Ok Bankruptcy AttorneyThe Best Guide To Tulsa Debt Relief Attorney

Advertisements by Money. We might be compensated if you click this ad. Advertisement As an everyday customer, you have two main phases of insolvency to select from: Chapter 7 and Chapter 13. We highly advise you very first gather all your financial papers and seek advice from a lawyer to understand which one is finest for your scenario.The clock starts on the filing date of your previous instance. If the courts reject your bankruptcy proceeding without prejudice (significance without suspicion of scams), you can refile promptly or submit an activity for reconsideration. If a judge rejected your case with prejudice or you willingly disregarded the instance, you'll have to wait 180 days before filing again.

Jennifer is additionally the author of "Thrive! ... Affordably: Your Month-to-Month Guide to Living Your Finest Life Without Breaking the Financial institution." The publication offers recommendations, pointers, and financial management lessons geared toward helping the reader highlight toughness, identify mistakes, and take control of their financial resources. Jennifer's essential economic advice to her buddies is to always have an emergency fund.

All financial debts are not produced equivalent. Some financial obligations are a concern based on that is owed the debt.

The Facts About Tulsa Bankruptcy Attorney Revealed

And since of this many people will certainly inform me that they don't desire to consist of certain debts in their personal bankruptcy situation. It is totally easy to understand, however there are two issues with this.

Also though you may have the finest purposes on settling a particular financial obligation after bankruptcy, life occurs. The circumstances of life have actually led you to bankruptcy because you could not pay your financial debts.

The majority of commonly I see this in the clinical field. If you owe a physician money and the financial obligation is discharged in insolvency, don't be amazed when that medical professional will certainly no much longer have you as a client.

If you want those dental braces ahead off one day, you will likely require to make some type of repayment setup with the excellent physician. The alternative in both scenarios is to choose a brand-new medical professional. To respond to the concern: there is no picking and finding, you must disclose all debts that you owe as of the moment of your bankruptcy filing.

How Bankruptcy Law Firm Tulsa Ok can Save You Time, Stress, and Money.

If you owe your family members money before your case is submitted, and you hurry and pay them off and then anticipate to submit insolvency you must likewise expect that the personal bankruptcy court will connect to your household and attempt and obtain that money back. And by try I mean they will certainly sue them and make them return to the cash (that won't make points awkward at all!) That it can be dispersed among all of your lenders.

There are court declaring fees and lots of individuals hire a lawyer to browse the complex process., so before declaring, it's essential that you plainly comprehend which of your financial obligations will be discharged and which will certainly continue to be.

There are court declaring fees and lots of individuals hire a lawyer to browse the complex process., so before declaring, it's essential that you plainly comprehend which of your financial obligations will be discharged and which will certainly continue to be.The Main Principles Of Bankruptcy Lawyer Tulsa

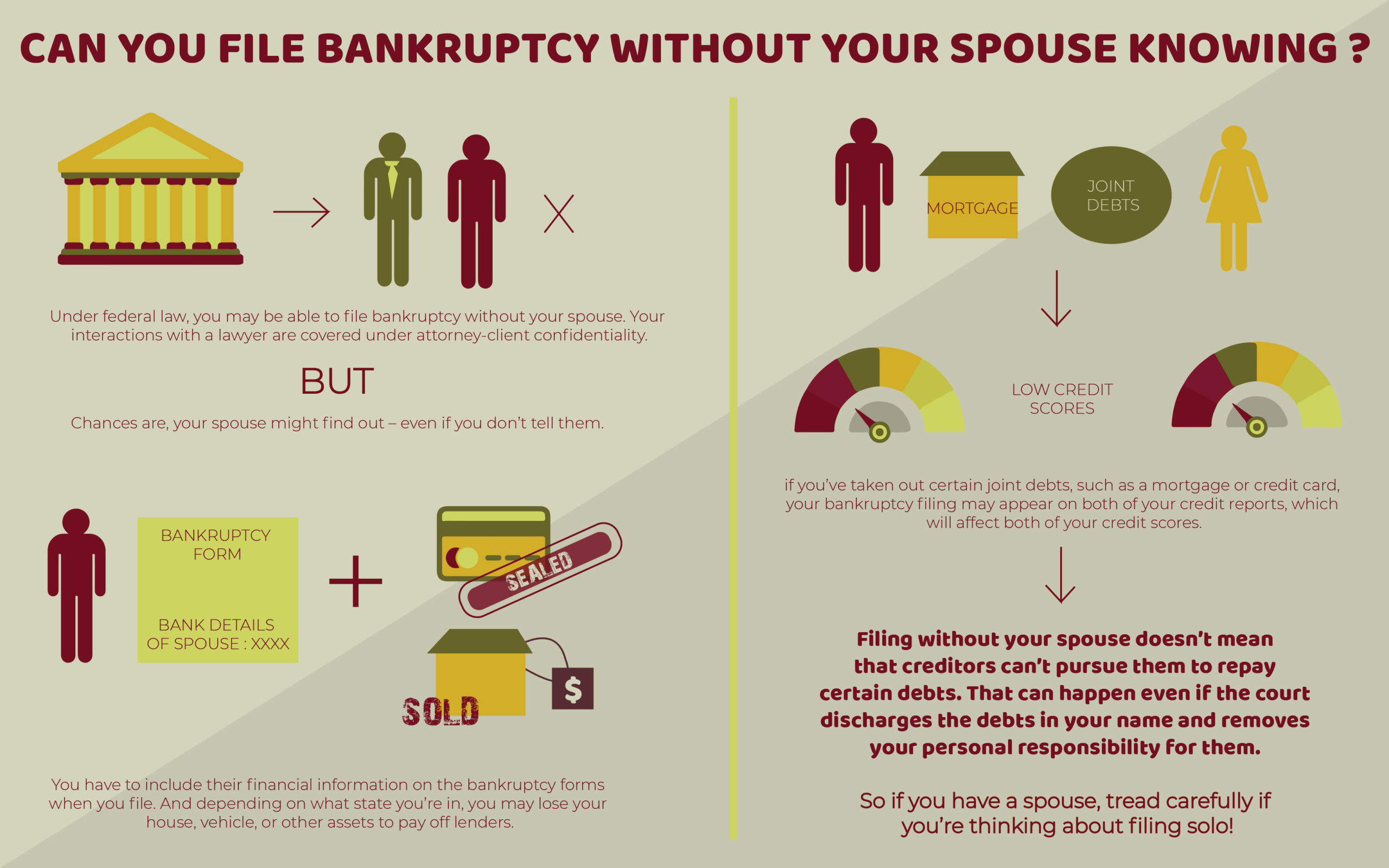

If you're wed or in a domestic collaboration, your insolvency filing might also influence your companion's financial resources, especially if you have joint debts or shared properties. Discuss the implications with your companion and consider looking for guidance on just how to safeguard their financial interests. Personal bankruptcy ought to be deemed a last resource, as the influence on your financial resources can be significant and lasting.

Before you make a decision, ask yourself these questions and weigh your various other choices. In this way, you're far better prepared to make an informed decision. Angelica Leicht is senior editor for Handling Your Money, where she writes and modifies articles on a series of individual finance subjects. Angelica previously held editing and enhancing roles at The Easy Dollar, Interest, HousingWire and various other financial publications.

A number of research studies suggest that medical financial obligation is a considerable cause of many of the insolvencies in America. If you have excessive financial obligation, personal bankruptcy is a government court process created to aid you eliminate your financial debts or repay them under the defense of the personal bankruptcy court.

The 7-Minute Rule for Experienced Bankruptcy Lawyer Tulsa

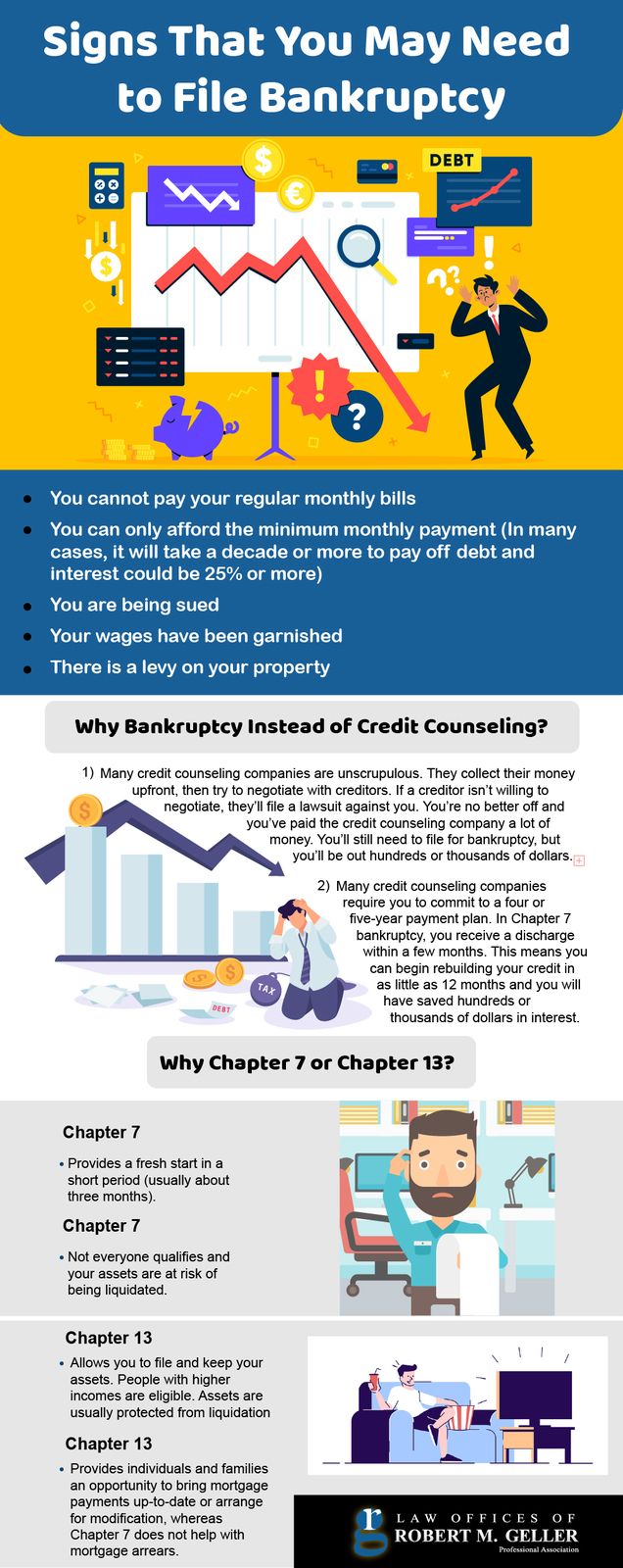

Attempts to manage your costs have stopped working, even after checking out a credit score therapist or attempting to stick to a financial debt consolidation strategy. Your attempts to work with creditors to set up a financial obligation payment plan have actually not worked.

Attempts to manage your costs have stopped working, even after checking out a credit score therapist or attempting to stick to a financial debt consolidation strategy. Your attempts to work with creditors to set up a financial obligation payment plan have actually not worked.There are court filing charges and lots of individuals hire a lawyer to navigate the intricate procedure., so before filing, it's essential that you plainly comprehend which of your financial obligations will certainly be released and which will stay.

Bankruptcy Lawyer Tulsa Fundamentals Explained

If you're married or in a domestic collaboration, your insolvency declaring could also affect your partner's funds, especially if you have joint financial obligations or shared properties. Discuss the ramifications with your companion and consider looking for guidance on just how to secure their financial interests. Insolvency needs to be deemed a last hope, as the effect on your funds can be considerable and long-lasting.

Prior to you make a choice, ask yourself these concerns and evaluate your various other alternatives. In this way, you're much better prepared to make a notified choice. pop over to this website Angelica Leicht is senior editor for Managing Your Money, where she composes and edits posts on a variety of personal money subjects. Angelica previously held modifying roles at The Easy Dollar, Interest, HousingWire and other financial magazines.

More About Tulsa Bankruptcy Legal Services

Several researches suggest that clinical debt is a substantial cause of many of the insolvencies in America. If you have too much financial obligation, insolvency is a federal court process designed to help you remove your financial obligations or repay them under the protection of the personal bankruptcy court.

The interpretation of a borrower that may file insolvency can be found in the Personal bankruptcy Code. Attempts to manage your costs have failed, even after seeing a credit scores therapist or trying to adhere to a financial obligation loan consolidation strategy. You are not able to fulfill financial obligation obligations on your present revenue. Your attempts to deal with site web creditors to set up a financial debt payment strategy have not functioned.

Report this page